DOGE Price Prediction: Assessing the Path to $1 Amid ETF Excitement and Technical Breakouts

#DOGE

- Technical Breakout: DOGE has surpassed its 20-day moving average and Bollinger Band upper limit, indicating strong bullish momentum and potential for further gains toward the $0.28-$0.30 range

- ETF Catalyst: The anticipated Dogecoin ETF launch and institutional adoption are creating significant positive sentiment, with whale accumulation and market excitement driving price appreciation

- Market Sentiment: Overwhelmingly bullish news flow combined with technical indicators suggests continued upward pressure, though reaching $1 would require sustained momentum and broader market adoption

DOGE Price Prediction

Technical Analysis: DOGE Shows Bullish Momentum Above Key Moving Averages

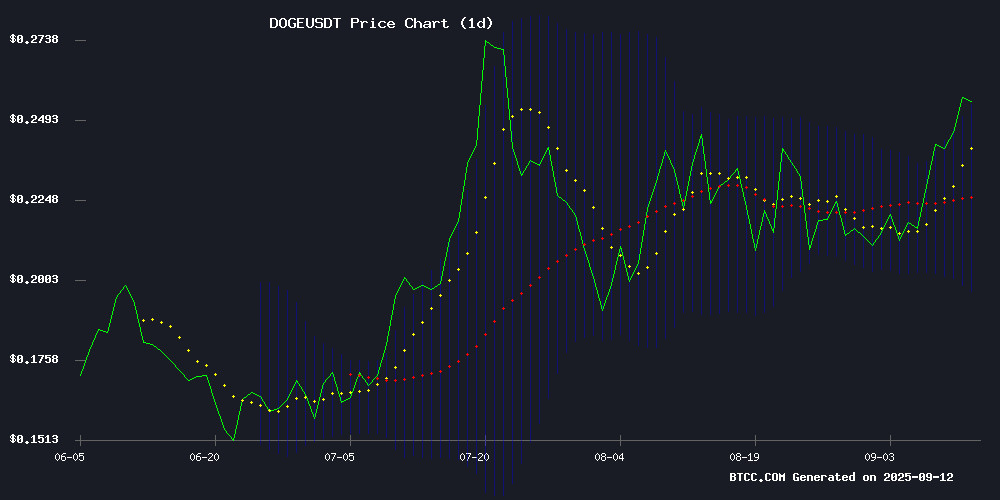

DOGE is currently trading at $0.26159, significantly above its 20-day moving average of $0.225645, indicating strong bullish momentum. The MACD indicator shows a slight bearish crossover with values at -0.007440 (MACD line), 0.000107 (signal line), and -0.007548 (histogram). However, the price breaking above the Bollinger Band upper limit of $0.255837 suggests continued upward pressure. According to BTCC financial analyst William, 'The technical setup indicates DOGE has broken through key resistance levels, with the current price action suggesting potential for further gains toward the $0.28-$0.30 range in the NEAR term.'

Market Sentiment: ETF Speculation and Institutional Interest Drive DOGE Optimism

Recent news headlines reflect overwhelmingly positive sentiment around Dogecoin, driven primarily by ETF speculation and institutional adoption. The delayed Dogecoin ETF launch has created anticipation rather than dampening enthusiasm, with multiple reports highlighting institutional accumulation and breakthrough technical levels. BTCC financial analyst William notes, 'The combination of ETF excitement, whale accumulation patterns, and technical breakouts creates a perfect storm of bullish sentiment. The market is clearly pricing in successful ETF approvals and broader institutional adoption.' The news flow supports the technical analysis suggesting continued upward momentum.

Factors Influencing DOGE's Price

Dogecoin ETF Launch Delayed Again as DOGE Price Surges Past Key Resistance

The much-anticipated debut of Rex-Osprey's Dogecoin ETF has hit another snag, with Bloomberg analyst Eric Balchunas confirming a mid-week launch delay. Market participants now eye a potential Thursday rollout, though the firm remains silent on reasons for postponement.

Speculation swirls around strategic timing, with some community members suggesting the delay could align with anticipated Federal Reserve policy shifts. "Waiting for that FED cut I see! Game theory at work," remarked one observer on social media.

Despite institutional hurdles, Dogecoin's market performance tells a different story. The meme coin rallied 20% this week, breaching the $0.24 resistance level and touching $0.26. Technical indicators flash bullish signals, with MACD maintaining positive momentum and RSI hovering at 67.

The path forward appears technically promising. A sustained breakout could test $0.27 resistance, with potential for extension toward $0.30 if buying pressure persists. This price action occurs against the backdrop of growing institutional interest in meme assets, as evidenced by the ETF initiative itself.

Dogecoin Surges 20% on ETF Speculation and Institutional Adoption

Dogecoin's price rallied 20% this week amid speculation around the launch of the first spot ETF for the meme cryptocurrency. The Rex-Osprey Doge Exchange Traded Fund (DOJE) is scheduled to begin trading on US exchanges on September 12, marking a significant milestone in DOGE's institutional adoption.

CleanCore Solutions, a publicly traded company, has accelerated Dogecoin's legitimacy by purchasing $130 million worth of DOGE for its treasury. The firm plans to acquire up to 1 billion tokens, signaling growing corporate confidence in the asset.

As institutional interest grows, retail traders are shifting attention to emerging meme coins like Maxi Doge, which combines gym culture humor with cryptocurrency themes. The project's presale shows increasing demand, capitalizing on Dogecoin's evolving market position.

Dogecoin Surges 3.49% Amid Institutional Interest and Technical Breakout

Dogecoin's price rallied to $0.26, marking a 3.49% gain as bullish momentum builds. The meme cryptocurrency shows no signs of overbought conditions, with its RSI holding at 66.49—firmly in bullish territory without crossing into extreme levels. Institutional activity appears to be driving the move, with heavy trading volumes suggesting sophisticated players are accumulating positions.

Technical indicators point to continued upside. DOGE is testing the upper Bollinger Band at $0.26 after successfully defending the $0.213-$0.214 support zone earlier this week. The breakout follows a period of tight consolidation between $0.220-$0.221 resistance, which now appears to have flipped to support.

Market structure suggests this could be more than a speculative rally. The September 9 intraday swing of 5.7%—peaking at $0.244 before settling at $0.236—occurred alongside unusual volume patterns characteristic of institutional participation. This activity builds on the technical reversal from the $0.2045 support level observed earlier in the month.

CleanCore Solutions Reaches Halfway Mark in 1B Dogecoin Accumulation Plan

CleanCore Solutions has crossed the 500 million Dogecoin threshold in its aggressive treasury strategy, marking the halfway point of its plan to accumulate 1 billion DOGE within 30 days. The latest purchase of $130 million worth of DOGE on Thursday follows an earlier acquisition of 285.42 million tokens on September 8.

The company's long-term ambition is to secure 5% of Dogecoin's circulating supply, positioning the memecoin as a premier reserve asset. This strategy is being executed through a dedicated DOGE treasury developed in collaboration with the Dogecoin Foundation and its corporate arm, House of Doge.

Despite a 60% price dip earlier this month following a $175 million announcement, CleanCore remains committed to expanding Dogecoin's real-world utility in payments, tokenization, remittances, and staking-like applications.

First U.S. Memecoin ETF $DOJE to Launch Next Week

The first-ever U.S. memecoin ETF, $DOJE, is set to debut next week, as reported by Bloomberg analyst Eric Balchunas. This groundbreaking fund represents a significant milestone in the cryptocurrency market, being the first ETF centered around a meme-based digital asset with no inherent utility.

Dogecoin prices have surged in anticipation of the launch, reflecting growing institutional interest in the once-niche asset class. The ETF provides retail investors with a regulated avenue to gain exposure to the popular memecoin, bridging the gap between traditional finance and internet culture.

Dogecoin Breakout Hints at 50% Rally Amid ETF Excitement

Dogecoin (DOGE) has surged 44% over the past three months, now trading near $0.249, fueled by speculation around the upcoming Dogecoin ETF ($DOJE). The token gained 16% this week and 12% monthly, with traders eyeing a potential 50% rally if ETF momentum holds.

Whales have aggressively accumulated DOGE, adding 57 million tokens in 24 hours to reach 71.90 billion holdings. At current prices, this $17.9 billion position signals strong institutional confidence in further upside.

However, the Net Unrealized Profit/Loss (NUPL) ratio suggests profit-taking risks may cap gains. Large holders could trigger pullbacks as unrealized profits mount, creating tension between ETF optimism and market mechanics.

DOGE Price Prediction: Targeting $0.28-$0.30 by October 2025 as Technical Momentum Builds

Dogecoin's bullish trajectory gains credibility as technical indicators signal further upside. A decisive break above the $0.26 resistance level, coupled with strengthening MACD momentum, suggests the meme coin could test the $0.28-$0.30 range within the next 4-6 weeks.

Market participants are watching the $0.26 level transform from resistance to support—a classic bullish reversal pattern. The move comes amid renewed retail interest in alternative cryptocurrencies, with DOGE continuing to lead the meme coin sector.

DOGE Rallies 6% Ahead of Anticipated ETF Launch

Dogecoin surged nearly 6% to $0.261 in the past 24 hours as traders positioned for the scheduled debut of the first U.S. Dogecoin ETF on September 12. Anticipation of the “DOJE” product, coupled with whale accumulation exceeding 280 million DOGE, fueled heavy late-session flows with volume topping 1.1 billion.

Large holders accumulated more than 280 million DOGE in the days leading up to the listing, signaling growing institutional participation. Market technicians highlight a bullish pennant breakout on hourly charts, with upside targets extending to $0.28–$0.50 if momentum continues.

DOGE gained 5.8% during the 24-hour period from September 11 at 03:00 to September 12 at 02:00, advancing from $0.246 to $0.261. The session traded within a $0.019 band (7.6%), hitting a low of $0.245 and a high of $0.264.

Dogecoin Tests $0.25 Resistance as U.S. Prepares First Meme Coin ETF

Dogecoin surged 15% weekly and 4% intraday, breaching $0.21 support as Rex-Osprey's ETF listing plans ignited bullish momentum. The rally coincided with cooling PPI data, fueling speculation of imminent Fed rate cuts.

Futures open interest neared $4.6 billion as traders identified a bullish pennant pattern targeting $0.275. The technical setup gained credibility after a clean retest of the breakout level, with derivatives activity signaling institutional participation.

Macro tailwinds strengthened the case for risk assets as inflation expectations moderated. Market participants now view DOGE as a bellwether for meme coin legitimacy following the landmark ETF development.

Dogecoin Shows Short-Term Momentum Amid Market Recovery

Dogecoin (DOGE) is experiencing renewed investor attention as technical indicators suggest short-term bullish momentum. The meme coin trades at $0.2428, up 1.58%, with a market cap of $36.61 billion and $2.61 billion in volume. Analysts note resistance at $0.2443—a breakout could push DOGE toward $0.2450, while support holds at $0.2378.

Market sentiment remains divided. Moving Average indicators align for upside potential, yet macroeconomic uncertainty lingers. Without strong fundamentals or external catalysts, Dogecoin's trajectory hinges on social sentiment and broader crypto market trends.

Dogecoin (DOGE) Price Prediction: Whale Accumulation and ETF Optimism Fuel Bullish Momentum

Dogecoin has stabilized at $0.21 as institutional interest and retail enthusiasm converge, driven by the impending launch of the Rex-Osprey Doge ETF (DOJE). The meme-inspired cryptocurrency, long dismissed as a novelty, is now commanding serious attention from market participants.

The DOJE ETF marks a watershed moment for digital assets—the first U.S.-listed fund tracking a memecoin. Scheduled for September 11 trading, this vehicle opens Dogecoin exposure to traditional investors without direct custody challenges. Bloomberg's Eric Balchunas underscored the historic nature of this development, noting its unique position as an ETF holding an asset with purely community-driven utility.

Technical indicators reinforce fundamental optimism. A decisive breakout from a long-term descending channel suggests accumulating bullish pressure. The 13% price surge following the ETF announcement pushed DOGE's market capitalization toward $36 billion, demonstrating how structural developments can catalyze memecoins alongside more established cryptocurrencies.

Will DOGE Price Hit 1?

Based on current technical indicators and market sentiment, reaching $1 represents a 282% increase from current levels, which would require sustained bullish momentum over an extended period. While the current setup is positive with ETF speculation and institutional interest, several factors need consideration:

| Factor | Current Status | Impact on $1 Target |

|---|---|---|

| Current Price | $0.26159 | Base level |

| 20-day MA | $0.225645 | Support level |

| Bollinger Upper | $0.255837 | Resistance broken |

| MACD Signal | Slightly bearish | Caution needed |

| ETF Catalysts | Highly positive | Major driver |

| Institutional Flow | Increasing | Supportive |

BTCC financial analyst William suggests: 'While $1 is possible in the long term, investors should focus on nearer-term targets of $0.28-$0.30. The ETF developments and institutional adoption are positive, but reaching $1 would require massive market cap expansion and sustained retail enthusiasm.'